IBM Envizi software module

ESG frameworks reporting software and tools

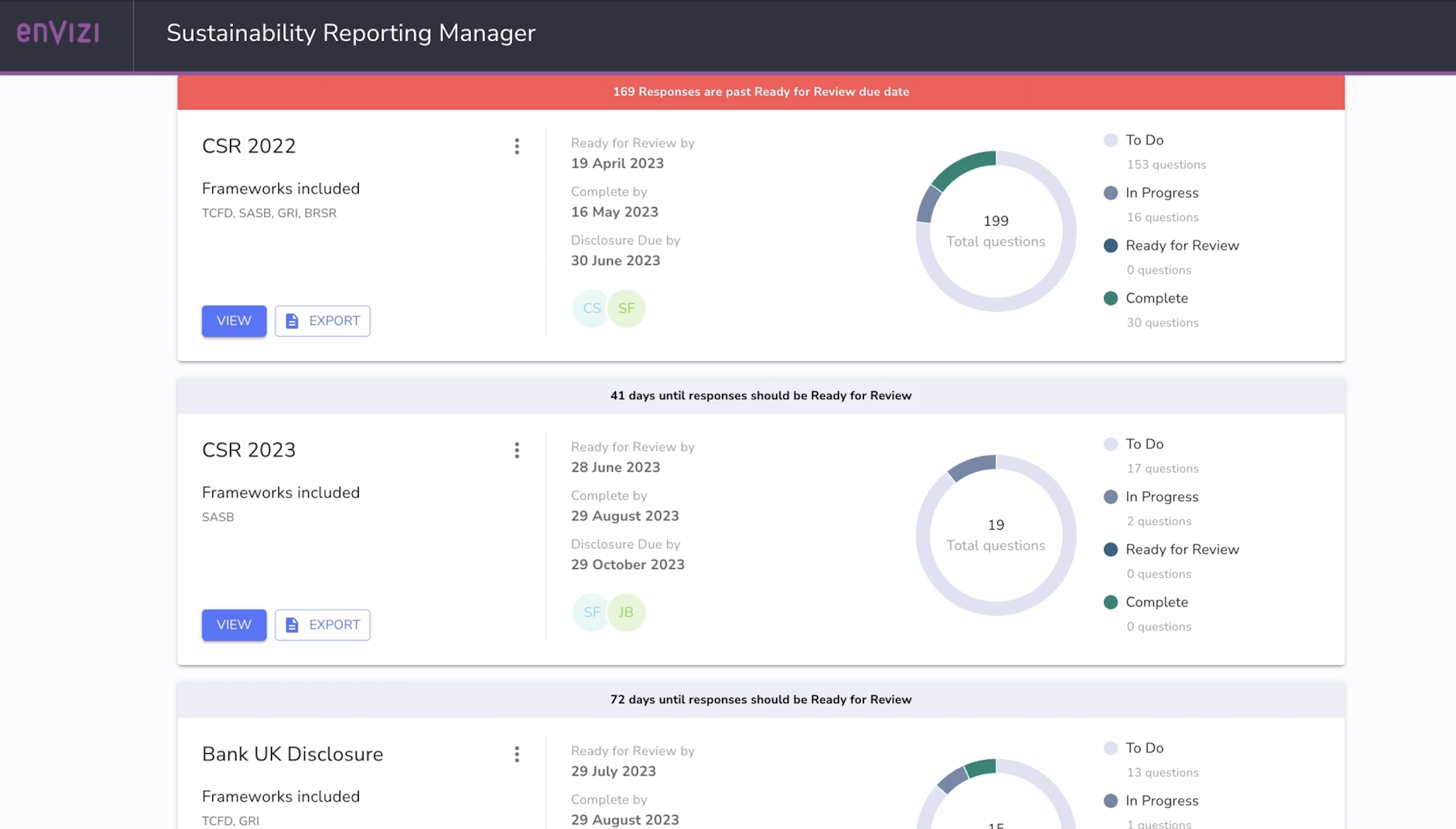

Report to multiple major frameworks from one dataset

Book your ESG Optimiser demo hereStreamline the effort required to compile volumes of data requirements across multiple stakeholders

Keeping track of multiple ESG framework disclosures and analysing ESG reporting is difficult without an efficient system in place. It is not only an immense strain on both time and resources, but it is crucial to ensure finance-grade levels of accuracy and full auditability.

Inadequate management of these essential responsibilities can mean unforeseen difficulties down the road. That is why having an effective process is essential for any successful organization.

This module includes over 1,000 questions from all major international ESG reporting frameworks, such as ISSB (IFRS), SASB, GRI, UN SDGs and CDP, which are kept up to date as reporting requirements change.

In addition, responses can also be reused from previous years and similar responses can be reused across different ESG frameworks.

Module features

ESG framework integration

Input your data against framework questions into ESG Optimiser so you don’t need to access each external ESG reporting framework separately.

Custom questions

Create custom questions to track specific reporting requirements not covered by the public ESG frameworks.

Best practice guidance

Framework questions include ESG Optimiser’s best practice guidance on responding, as well as where to source the ESG metrics in the platform.

Would you like to see how IBM Envizi – our fully integrated ESG data and analytics platform works?

Book a 30 minute demo, and chat with an ESG data expert

Report to multiple ESG frameworks from one dataset

Accessing performance data for multiple, different ESG frameworks has never been simpler. Reporting complexity is now a thing of the past. With this platform, you can quickly access all ESG performance data in a single system, saving you valuable time and resources.

From there, the single system allows you to update, manage and report your ESG performance data through each of your chosen frameworks at the same time, without rekeying or regenerating responses for each separate framework. Responses can simply be copied through, wherever required across frameworks.

You will dramatically reduce reporting complexity with our single, unified platform – unlocking unprecedented access to all your ESG performance data.

Elevate your ESG reporting with finance grade data management. Our solution provides a comprehensive, secure, and efficient system that enables auditors to confirm your data integrity.

From corporate sustainability reporting to annual and sustainability reports, the outcome is accurate with thorough presentations that capture the value of your business.

In order to manage and report your ESG data in accordance with external ESG reporting frameworks, it is imperative to systematically manage all associated inputs.

These inputs include disclosures for the overall frameworks and include topic specific standards, risk and opportunities and other underlying measures which objectively assess long term ESG performance.

Taking a proactive approach to the application of ESG standards and developing robust routines enables you to stay up to date, fulfil legislation and creates a platform for comprehensive sustainability planning and improved performance.

Making efficient use of your time is essential when managing corporate sustainability reporting. By reusing previous and similar responses across ESG frameworks, sustainability reports, and annual report requirements, you can reduce the burden of constantly creating distinct responses.

If you haven’t seen an overview of the complete ESG Optimiser solution, with 9 integrated platform modules, an additional 5 specialist tools, and a comprehensive implementation and support service, just click here.

Your ESG team

Ikano Insight’s team of expert sustainability consultants will guide your business through all aspects of sustainability strategy, from data management to GHG calculations, framework reporting to legislative audits and compliance, and software implementation to business performance improvement.

Our team are there to help you every step of the way, as little or as much as you need, on your sustainability journey.

Head of Sustainability

Peter Jones

peter.jones@insight.ikano

Snr Sustainability Business Analyst

Innes Christison

innes.christison@insight.ikano

Sustainability Business Analyst

Emily Blenkley

emily.blenkley@insight.ikano

Peter Jones

Head of Sustainability

Innes Christison

Snr Sustainability Business Analyst

Emily Blenkley

Sustainability Business Analyst

Frequently asked questions

What are ESG frameworks, and why are they important for reporting?

ESG frameworks refer to established standards and guidelines used to assess Environmental, Social, and Governance factors in a company’s operations. These frameworks help organisations measure and report their performance in areas of sustainability, social responsibility, and ethical practices. By adhering to ESG frameworks, companies can demonstrate their commitment to sustainable practices and transparency, gaining trust from stakeholders and investors.

Which are the major international ESG frameworks used for reporting?

Some of the major international ESG frameworks used for reporting include:

- Global Reporting Initiative (GRI)

- Sustainability Accounting Standards Board (SASB)

- United Nations Global Compact (UNGC)

- Carbon Disclosure Project (CDP)

Are there any guidelines for selecting the most suitable ESG framework for a company?

Yes, selecting the right ESG framework depends on various factors, including the company’s industry, size, and geographic location. Additionally, companies should consider their stakeholders’ expectations and the specific ESG issues that are most relevant to their operations. Conducting a materiality assessment can help identify the most significant ESG topics for a company to report on.

What are the benefits of reporting against major international ESG frameworks?

Reporting against ESG frameworks offers several benefits:

- Enhanced transparency and accountability.

- Improved risk management and identification of opportunities.

- Strengthened reputation and brand value.

- Better engagement with investors, customers, and other stakeholders.

- Access to sustainable finance and investment opportunities.

Can companies use multiple ESG frameworks for reporting simultaneously?

Yes, companies can use multiple ESG frameworks for reporting. However, it is essential to ensure consistency and avoid duplicating efforts. Integrating various frameworks into a cohesive reporting strategy can be challenging but can provide a more comprehensive view of the company’s sustainability performance.

How can companies stay up-to-date with evolving ESG reporting requirements?

Staying up-to-date with evolving ESG reporting requirements involves regularly monitoring changes in ESG frameworks, regulations, and investor expectations. Companies can join industry networks, attend conferences, and engage with sustainability experts to stay informed and align their reporting practices with current standards.

Book a demo

Let’s chat!

If you’d like to chat with us to see how we can help you achieve your sustainability goals, including measurement, reporting and compliance, just pick a time that suits you in Peter’s calendar.

Review your sustainability objectives, challenges and see which platform modules would match your needs.

Get in touch

Let’s chat!

If you’d like to chat with us to see how we can help you achieve your sustainability goals, including measurement, reporting and compliance, just pick a time that suits you in Peter’s calendar.

Review your sustainability objectives, challenges and see which platform modules would match your needs.

Related products

ESG building benchmarks and ratings

Simplify data collection and reporting across your property portfolio

Value chain assessments and surveys

Securely capture ESG data from third parties for value chain analysis

Track ESG goals with sustainability dashboards

Visualise sustainability data in one place for stakeholders and team members